Business operations and personal lives are at higher risks in the modern digital age from cyberattacks. As these threats become complex, so does the necessity to have strong security measures along with insurance mechanisms. Cyber insurance coverage offers a financial cushion against cyber incidents, whereas the Silverfort platform enhances the resilience of cybersecurity. The article delves into how cyber insurance coverage interacts with Silverfort in enhancing the cybersecurity framework.

Understanding Cyber Insurance Coverage

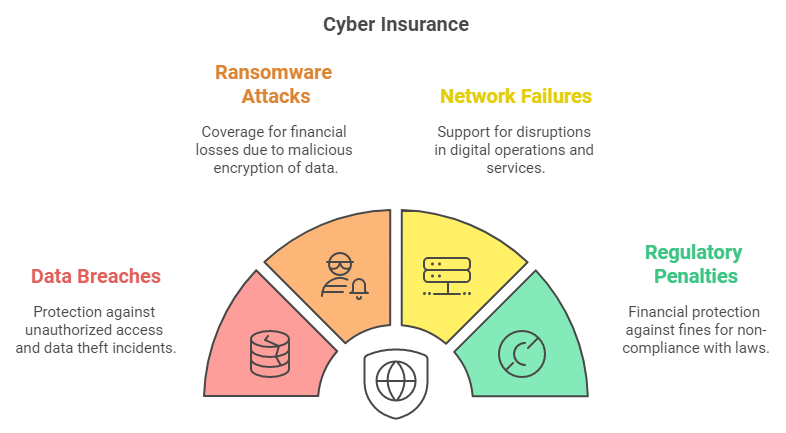

Cyber insurance is that kind of policy that addresses the monetary loss caused in case of cyber incidents. A variety of scenarios are covered including data breach, ransomware attack, network failure, and so on, through regulatory penalty. Cyber insurance is now no longer just a comfort but a business necessity of all sizes today due to the rise in digital transformation.

Key Components of Cyber Insurance Coverage

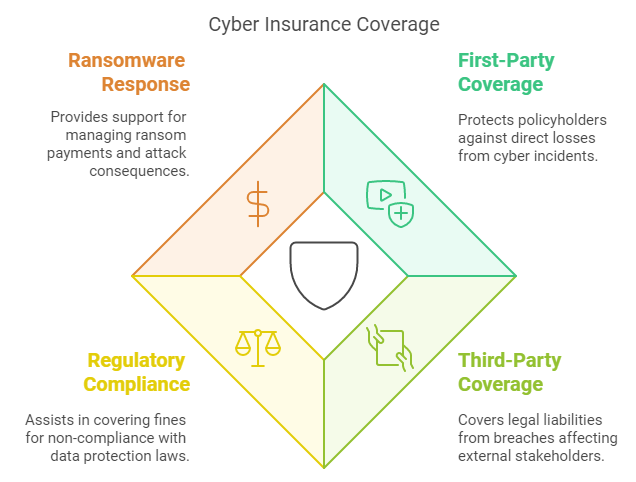

- First-Party Coverage: First-party coverage protects the policyholder directly against losses such as restoration costs, incident response expenditures, and business interruption loss.

- Third-Party Coverage: Legal liabilities arising from breaches with customers, vendors, or even other stakeholders.

- Compliances, Regulatory: Keeps in view the fines or penalties due to non-compliance with data protection regulations such as GDPR or CCPA.

- Ransomware response provides: financial support that guides the management of payments during ransomware attacks to limit the consequences.

The Importance of Cybersecurity for Insurance

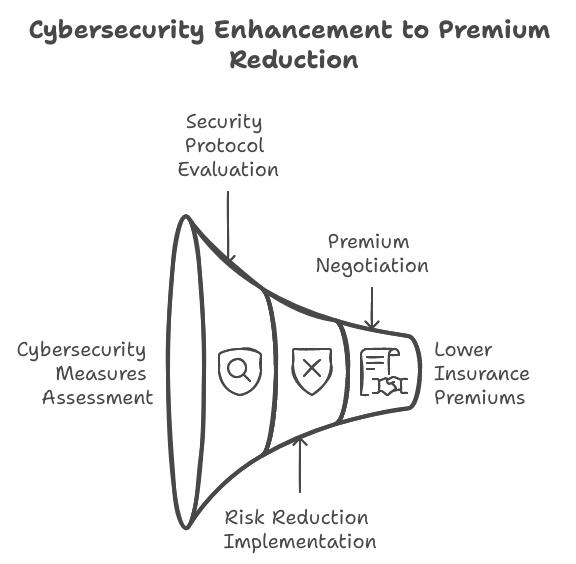

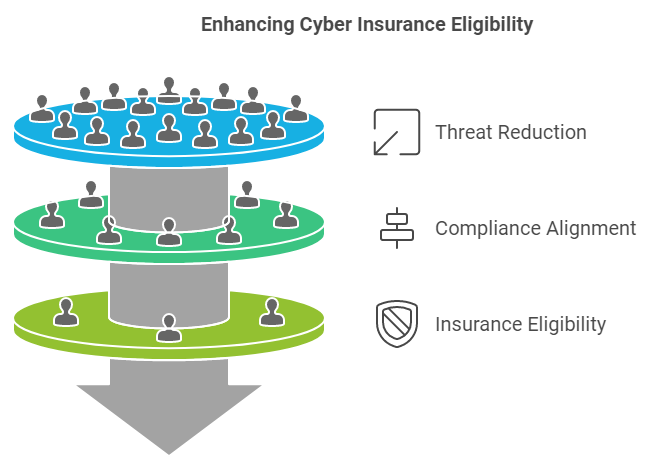

Insurance companies evaluate the cybersecurity of an organization before offering coverage. Strong security measures not only reduce the chances of attacks but also reduce the cost of insurance. This is where platforms like Silverfort come into play to enhance the cybersecurity infrastructure.

Silverfort: A Game-Changer in Cybersecurity

Silverfort is a top-notch cybersecurity platform specializing in identity protection and zero-trust access. It offers state-of-the-art solutions that fit in well with the demands of cyber insurance policies. Silverfort, in turn, protects digital assets proactively so that businesses remain less susceptible to threats, making them eligible for full-scale cyber insurance.

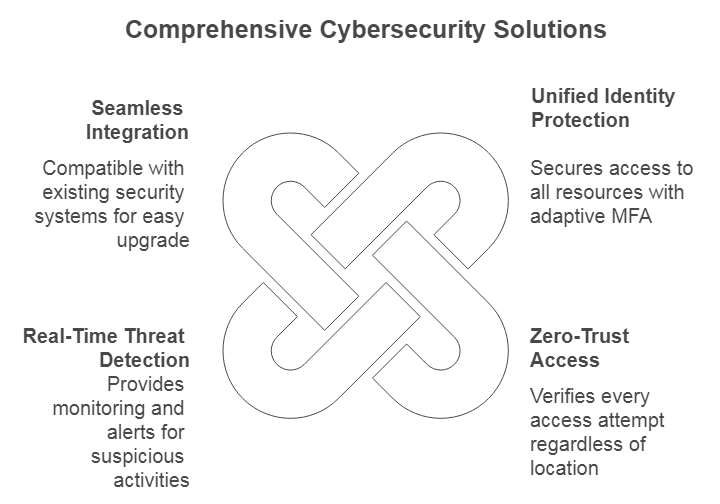

Key Features of Silverfort

Unified Identity Protection

Silverfort protects access to all resources—on-premises and in the cloud—by enforcing adaptive multi-factor authentication (MFA) across systems that have not had MFA compatibility.

Zero-Trust Access

The platform follows a zero-trust security model, where every access attempt is verified irrespective of the location or device of the user.

Real-Time Threat Detection

Silverfort provides real-time monitoring and alerts for suspicious activities, allowing organisations to respond rapidly to potential breaches.

Seamless Integration

Its compatibility with existing security ecosystems makes it a versatile choice for businesses looking to upgrade their cybersecurity measures without overhauling their infrastructure.

The Symbiosis of Cyber Insurance and Silverfort

A strong cybersecurity posture is always a prerequisite for obtaining cyber insurance coverage. Silverfort’s powerful identity and access management solutions provide the level of protection that insurers expect. This is how Silverfort augments cyber insurance policies:

- Risk Exposure Minimized: Silverfort prevents unauthorized access and detects anomalies early enough to minimize the chances of an effective cyberattack.

- Compliance Support: Silverfort helps organizations meet regulatory requirements that are often a condition of securing cyber insurance.

- Improved Incident Response

In the event of a breach, Silverfort’s detailed analytics and forensic tools facilitate incident management in a faster, more effective way: exactly what the policyholder is liable for to the insurance terms.

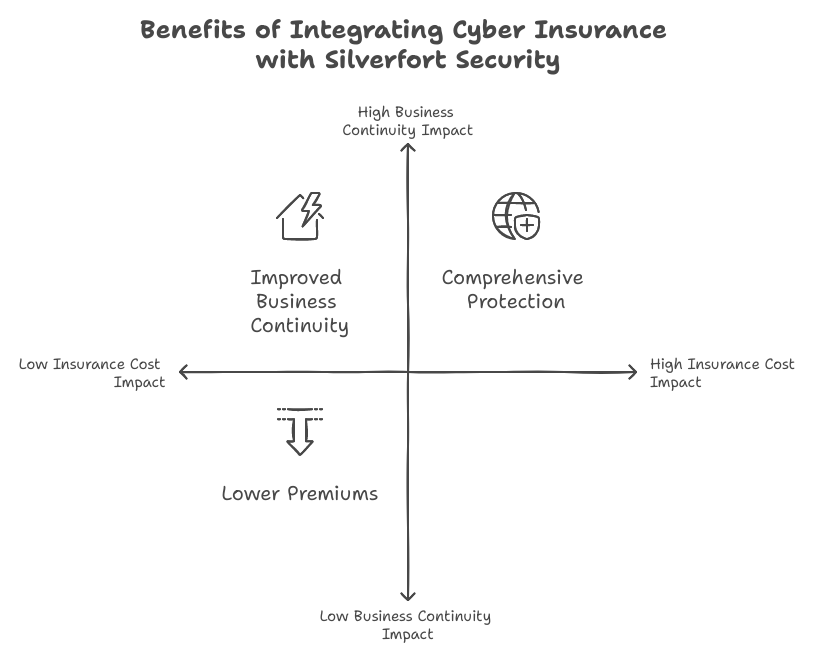

Benefits of Integrating Silverfort with Cyber Insurance

- Lower Premiums

Advanced security organizations such as Silverfort will have fewer risks, and their insurance costs will be lower as well. - Increased Protection

Cyber insurance along with Silverfort’s proactive security measures ensure holistic protection against financial and operational damages. - Enhanced Business Continuity

Silverfort threat detection and mitigation capabilities complement insurance coverage, allowing businesses to recover quickly after an incidence.

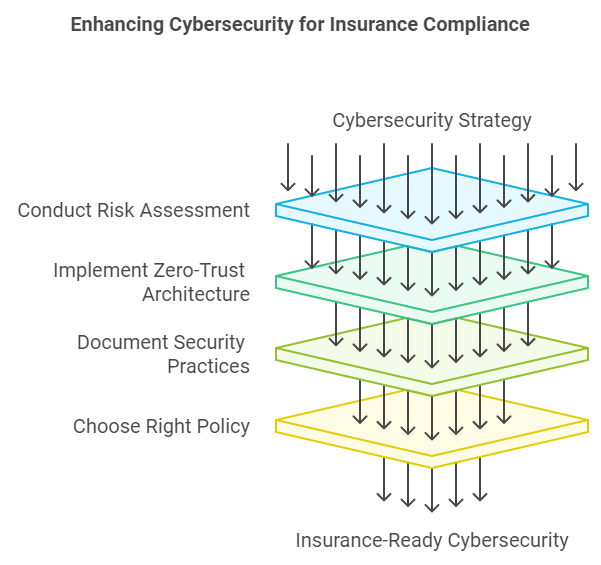

Steps to Secure Cyber Insurance with Silverfort’s Support

- Conduct a Risk Assessment

Identify vulnerabilities and ensure Silverfort’s solutions are in place to mitigate them. - Implement Zero-Trust Architecture

Use Silverfort to establish a zero-trust environment, a factor that insurers value highly. - Document Security Practices

Maintain detailed records of Silverfort’s integration and usage to demonstrate compliance with insurance requirements. - Choose the Right Policy

Work with insurance providers to select a policy that complements Silverfort’s protection level.

Future Trends: Cyber Insurance and Advanced Security Platforms

With cyber threats continuously evolving, insurers are bound to demand even stronger cybersecurity measures. Platforms like Silverfort are at the forefront of such evolution, with features like AI-driven analytics and predictive threat modeling. Such investments in such advanced security solutions will not only provide insurance coverage but also secure long-term resilience against cyber risks.

Conclusion

In a world where cyber threats are looming large, businesses cannot afford to ignore either cybersecurity or cyber insurance. Silverfort is the critical ally in this pursuit, providing the advanced protection required to meet insurance requirements and safeguard digital assets. By integrating Silverfort’s identity protection solutions with a comprehensive cyber insurance policy, organizations can achieve a robust defense against financial and operational risks posed by cyberattacks.