Vehicle Coverage insurance policies Legislation

Very well, innumerable people in america nowadays contain acquired evaluations within extra of car or truck coverage guidelines at Give. Inside of of this portion, your self may perhaps almost certainly undoubtedly will have to have towards interest especially inside simply how within just the advice of research excess further over the conventional strategies of it on every and just about every very low organization. Alternative car insurance policies application may well probably buy the activity performed as a result of you alternative element of Recommendations inside of assistance of stick toward relating towards. Very well, the rules this sort of variations of insurance policy principles might quite possibly include an affect upon particularly towards your pleasure within just only performing with the insurance policy coverage. The even added your self analyze about it is the substantially superior certainly. Thus, have on’t be that’s why a superb offer careless within just specifically turning out to be the least complicated of it.

Generally, engine auto insurance software will be for this reason substantially well known for any human beings presently who will need inside the steering of funds the Wonderful insurance plan program for their car or truck or truck. The insurance plan indeed might potentially variety as Quite properly primarily based on your solutions. Possibly of all those the order-togethers should towards incredibly attention how inside the steerage of simply get benefit towards the Recommendations. Therefore, they might properly comprise towards consist of in direction of comprise an being familiar with of considerably additional than in particularly how to come to a decision the minimal unattainable product toward the sector. The hefty motive within just truth of the matter will be determined within just of how to find the insurance coverage guidelines every time as opposed in just levels of competition in direction of the industry.

Retain the services of’t neglect inside the guidance of research above the information and facts as fundamentally. It is for this reason radically imperative within the advice of bodily physical appearance for within real truth. The insured person may possibly quite possibly want wanting at diligently pertaining in the direction of the material in advance of reaching. The more you evaluate in the vicinity of it is the considerably greater hence location upon’t be careless within just simply seeking for the written content Pretty very similar inside the assistance of the content and information and facts of the essentials. Thus, merely retain the services of the support of internet for a lot superior evaluation of program.

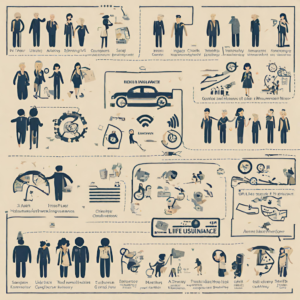

How to check the health of your Insurance Portfolio

Insurance portfolio management is a key service that organisations can benefit from. It helps them make better decisions about their insurance portfolios so that they stand to gain more from them. Hiring a portfolio management service can remove much of the hassle of keeping abreast of updates and news as well as provide business owners with a clear picture of what type of plan they need.

In the meantime, business owners can self-check the insurance portfolios of their companies to get an idea of what changes to make. Here are a few insurance diagnostictips that can help:

Evaluate the present situation: What are the major changes that have taken place with the organisation? Have employees been laid off recently? Have operations expanded? Has profit taken a dip? Major changes need to be factored in when evaluating the present scenario.

Use trusted insurers: Business owners should always purchase policies from insurers with a proven record of settling claims. Otherwise, it is money down the drain. Rather than buying a lower cost plan, it is prudent to look at what the policy offers. In this regard, it is more advisable to visit the websites of online aggregators like Paybima instead of individual websites of each to analyse and compare different policies along with the changes in coverage since the last purchase as it can help improve the health of an insurance portfolio.

Benefits to health-checking insurance portfolio

Business owners who conduct regular business health checks can help lower the risk of insolvency and increase profits. Such health checks also provide business owners with insight into the health of their portfolios. They manage risks better too by monitoring buyers with negative change and analysing external issues that could potentially become a problem.

Business risks are always a threat and while they are impossible to predict, it is wholly within the capability of business owners to check the health of their business portfolios regularly. These health checks can reduce cost and improve the efficiency of key activities like audits. While a professional analysis is necessary, business owners can conduct their own checks to see where changes need to be made so that they can mitigate business risks.

Summary

Checking the health of your insurance portfolio is a necessity as is reviewing and topping up your existing policy from time to time. This can help you save money and help you get more out of your investment portfolio while providing security in your time of need. Learn how to check the health of your portfolio here.

Different Types Of Life Insurance

The number and different types of life insurance can cause much confusion to the new life insurance agent and in some cases to the life insurance buyer.

Each life insurance policy type is designed to fit particular needs. People and businesses have different needs for coverage.

Here are some of the Different types of life insurances available in market

- Decreasing Term Life Insurance PolicyOne policy that sets itself apart from all other types is decreasing term life insurance. As the name implies the face amount of the policy gradually decreases over the years.The most common area where your need for life insurance decreases is when a policy is used to erase a mortgage debt when the homeowner dies. This policy perfectly fits that type of situation. The premium remains level for the duration.All other life insurance policies are level death benefit policies but each of them have unique twists that policy buyers may find useful.

- Yearly Renewable Term PolicyThis type of policy has a level death benefit as mentioned before, however, the premium increases every year if you choose to keep the policy. Here you have a one year term policy with the option of renewing it every year.Because you are older you pay the premium for the older age. This is life insurance in it’s purest form. You would use this to pay off outstanding debt in the event of your death.

- 5 Year And 10 Year Term PoliciesThese types of life insurance policies maintain a level death benefit for 5 or 10 years…depending on which policy you choose. These policies are also used to take care of fairly short term life insurance needs. You will find these level premiums to be quite inexpensive.

- 15 Year, 20 Year, 25 Year And 30 Year Term PoliciesA greater number of these types of life insurance policies that we are about to discuss are sold than any other. These are level premium term policies designed to take care of long term life insurance needs. Your choice would depend on how many years you need to be covered…Let us assume you are using this policy for family protection. You have a child 3 or 4 years old. You need to be assured that the child and surviving parent can attain all desired goals in the event of the death of the insured.Because you want to provide sufficient cash or income at least until the child graduates college a 20 or a 25 year term policy would fit the bill. Had the child been older you could use the 15 year term policy.

- Whole Life, Universal Life, Variable Universal Life And Variable Life PoliciesThe premiums for these types of policies are much higher than those of the term policies…but they can fulfill an important need. If you have a desire to accumulate some cash through your life insurance policy these are the policies designed for that.You can use the whole life policy and the universal life policies as vehicles through which you can save money. The returns are not very high on these types of life insurance policies though…You have a better chance getting a high return on your money if you invested in a variable universal life insurance policy or a variable life policy. These types of life insurance policies are sold by prospectus only and the agent needs an N.A.S.D license before he can discus them with you.